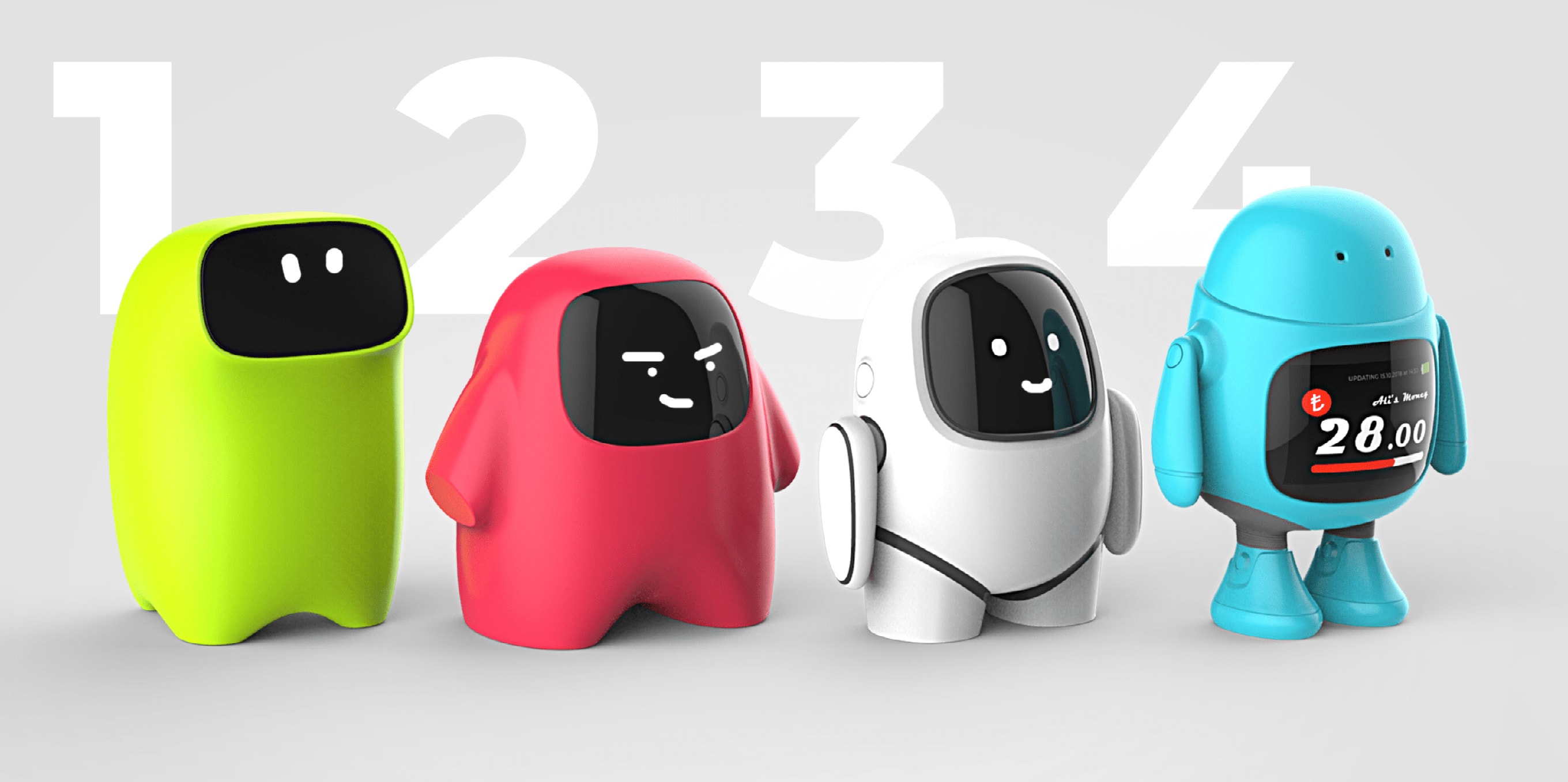

MoneyBot

Acquiring financial literacy skills at young ages is an effective investment for adulthood.

Why We Created?:

Money management is a crucial skill that needs to enter our lives as a child, that is, without waiting to be mature adults. Financial management skills gained at a young age, are the first step to achieve a lifelong financial qualification. We believe that it is right to give financial education which is missing even in many adults today, to the future generations.

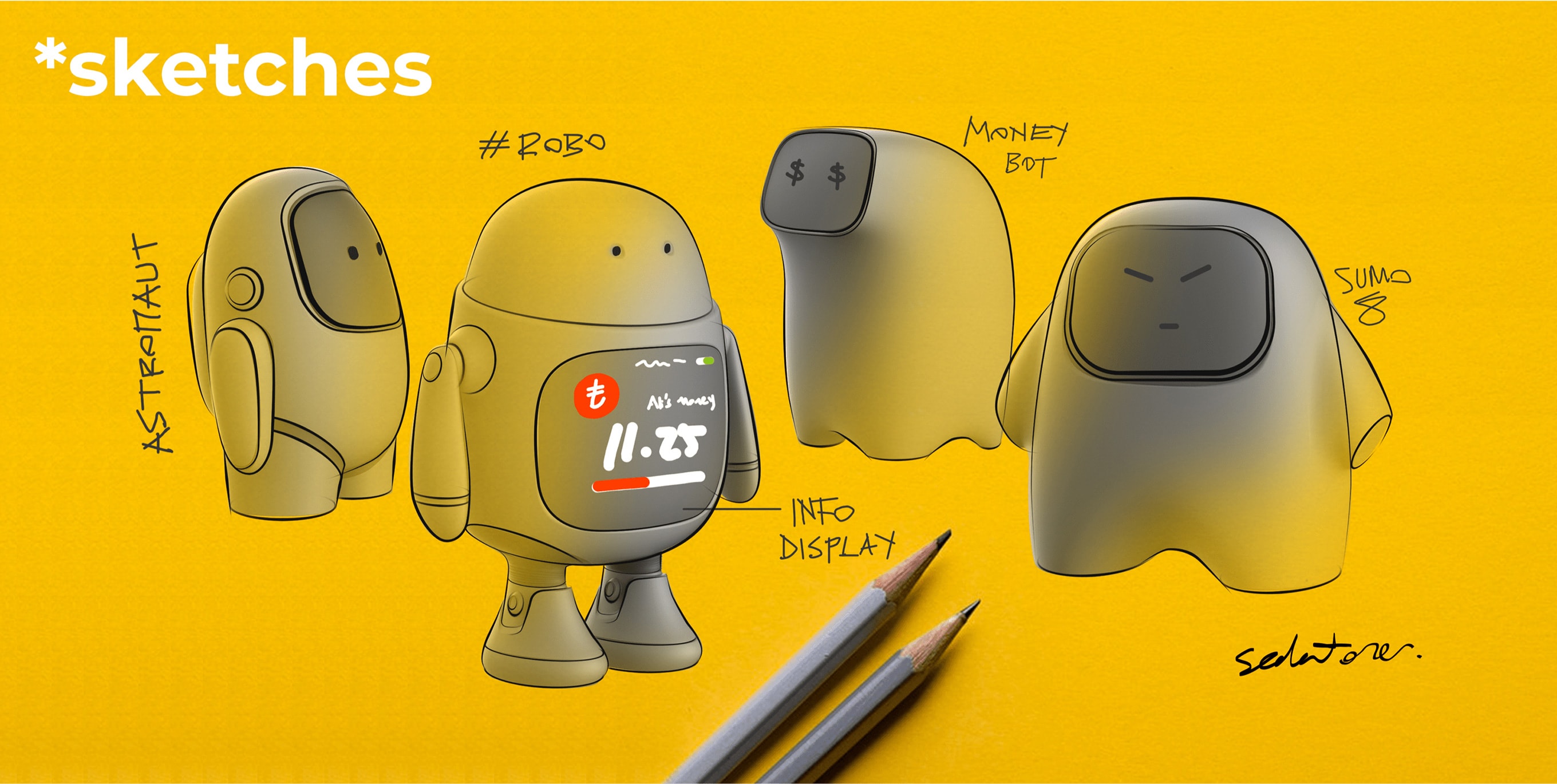

How We Created?:

We have sought to combine skills such as savings awareness with digital trends, to benefit young consciousness. While the digital elements support our financial management skills through various applications, we decided that the method of the piggy bank we are familiar with from childhood has been the right channel to bring many educational experiences to children. Building a habit and awareness were our priorities that we kept it that way while designing MoneyBot. As a result of that, the combination of a diverse and tangible world that can be updated within a device became the backbone of our crucial design approach.

Updatable:

Changing legislation, training elements and growing children made it necessary to create players and educational applications in MoneyBot updatable. Under the law no. 18/154 of the Turkish Constitution, minors can only be considered as a dependent under the account of the parents. To avoid this problem, the product had to be designed in a way to adapt and prevent the changing regulations and laws on the subject to eliminate the effectiveness of the product. The fact that the target audience will grow over time and the applications that will live in MoneyBot should be able to evolve with them.

- MoneyBot users,

- Money transfer apps,

- Saving apps,

- Investment apps,

With digital money applications, it addressed the need for application and interface development in multiple categories within the device.

Tangible:

The combination of analogue and digital will allow children to avoid all other applications they have interacted with. In addition to that, active cash use of children with target groups makes the product more meaningful.